Update #3: 金融Conference,美國供應鏈,中國去槓桿

金融Conference

有幾家金融公司在參加12初高盛論壇的Comment,對景氣仍十分看好,目前沒看到變差,就業市場持續吃緊,短期難以改善,供應鏈也是,供給端的狀況跟其他公司看法差不多,所以通膨仍是大問題,就是結構性通膨了,高盛提到得特別重要,我們習慣低通膨太久了,這一代沒人經歷高通膨,這對金融市場跟消費者行為都是需要調整,FED也是,明年或許通膨會緩解,但絕對是高於歷史平均。

JP Morgan (JPM)

- So my view on the economy, U.S. and global, is definitely positive. And the economies are doing well, and the business environment is very positive.

- When you look at consumer confidence, it's very high, which is looking at our own credit card numbers. And at the moment, when you look at expenses -- the amount of money [spending] through credit cards is around 17% higher than it was pre-pandemic. And it's across all items except airlines, which is a bit lower. So the consumers have a great balance sheet. They have accumulated savings over this time.

- And you can see all the reasons for that is people are gradually coming back into the workforce, but it's happening at a slow pace. The demand for jobs and people to do jobs is very high.

- The participation rate in the labor force has been -- is correcting, but it's very unlikely to get to the levels where it was pre-pandemic. So the labor shortage that is going to probably take the employment rate towards 3.5% at the end of next year and a bit lower at the end of '23 is an issue..

Bank of America (BAC)

- I don't see any impact yet. And if you go out to a restaurant, I don't see people change their behavior. The TSA numbers, you can see bounce around a little bit...but the reality is it seems like the vaccines continue to work, and we'll see what that plays out. I'm not the scientist, but it's got time and the data will get better, but we're not seeing any behavior change here.

- They're well employed, wages are rising and they're spending money, which I think in a day of a consumer-led economy in the United States.

- I think that's the unique thing I could add to it as they're spending and they're doing, that's just -- that bodes well for the U.S. economy.

- So our view is interest rates will rise next year multiple times and beginning sort of midyear, even maybe a little bit earlier, the tension would be how much earlier that could happen. But they (FED) have to sort of normalize the environment given everything going on.

- if you talk to people in the shipping industry, it's not a fix overnight. It takes a while because it's not just the ships, it's all the components of the process.

Goldman Sachs (GS)

- We’re still not completely out of the pandemic. There’s uncertainty that comes from that and that uncertainty is going to affect economic activity and we’re going to have to deal with that in some way.

- We clearly have real inflation in the economy. We’ve got a variety of problems, headwinds, issues that have occurred because we went into a pandemic, we shut the economy down, and we’re now, we’re turning it back on.

- And so there’s no, there’s no question that this has been an unprecedented period and so it’s very hard to predict how we’re going to come out of this.

- And so, I do think that while we’ve had inflation below trend for quite a significant period of time, there’s a reasonable chance that we’re going to have inflation above trend for a period of time.

- From 1970 to 1980, there was almost nothing you could own where you made money. Basically, during that 10-year period, oil and gold, cash you lost money. If you owned US equities during that 10-year period, you lost nearly 50% of the value of your holdings. So, people forget the historical perspective.

- It wasn’t too long ago in 2004 to 2006 I think it was June 2004 to June 2006, that as the Fed normalized rates, they hiked 17 times in that two-year period. Now I’m not saying that’s going to happen, but I think we’re living in a world where people are forgetting the history and this might be, you know, a period that’s different.

美國供應鏈

看到一篇關於供應鏈的看法,美國供應鏈瓶頸在於運輸,小的阻塞會造成複雜度高的供應鏈呈現指數型的阻塞,港口,卡車,鐵路都有很大的問題。

- First, just a bit of theory. Increased volumes often disrupt complex systems, based on what’s called the 'bullwhip effect.' This is the tendency of complex networks to amplify signals and increase variation. Part of the reason for this is that as a volume change runs through a dynamic supply chain, constraints appear — sometimes in unexpected places.

- So, a 10 percent increase in volume may result in a 40 percent slower time; a 25 percent increase in volume can bring on a total halt.

- Some estimates say the U.S. overall is shorthanded by as many as 80,000 drivers.

- To access a port, the driver needs a Federal government background check and is given a Transportation Worker ID Card (TWIC). Besides the general driver shortage, there is a specific shortage of TWIC certified drivers.This has been a nationwide problem.

- This is a new law that requires nearly all truck drivers to be treated as legal employees rather than private contractors.

- These same owner-operators are increasingly choosing other work since their pay for taking a container from the port hasn’t increased but delays have. Some drivers report in the past, they could move five to seven containers a day. Yet now, with current delays, they may be limited to two containers.

- Rail traffic is commonly a major factor in the ocean freight trade. Many containers bound for the Midwest and even East Coast arrive in a California port and are transferred to rail. Rail yards have suffered from similar capacity issues, with container chassis being a particular resource of concern.

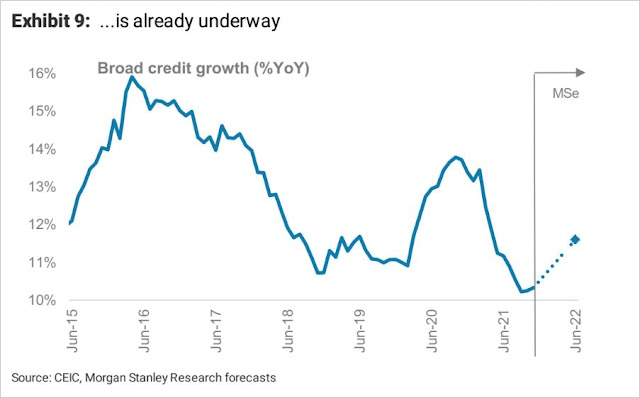

中國去槓桿

Comments

Post a Comment