Update #4: 飛機短缺,美國消費者財務體質

飛機供不應求

根據金融時報報導,現在航空公司要等兩年才會有新的單走道飛機,飛機分單走道跟雙走道,單走道是Airbus跟Boeing的主力,航空公司現在也最愛單走道,省油是很大原因,然後單走道的載客量跟航程都有再增加,現在發生需要等兩年也不意外,疫情前這兩家的訂單就累積了七年左右,疫情又讓供應鏈吃緊,然後飛機製造又是寡占,航空公司在怎麼急,除了這兩家,也找不到其他家可以補,消費者更不會想坐中國或俄羅斯製造的飛機,現在是等生活在正常化了,Boeing跟Airbus就等於是躺著數錢,但問題是,生活何時可以回到疫情前的正常呢?

- Airlines ordering popular single-aisle jets used on short-haul routes face a two-year wait for delivery as supply constraints persist, according to Airbus, the world’s largest aircraft-maker.

- demand from airlines for the company’s A320 family of jets was so strong that “by and large” delivery slots for larger orders were now around 2024-25.

- There is a supply constraint for the most desirable assets out there . . . on the single-aisle, this points towards the A320 and A321 and now also the A220.

- demand was fundamentally being driven by the need for more fuel-efficient aircraft.

- The Covid crisis has accelerated the realisation that the transition to more . . . fuel-efficient technology is inevitable.

- with many carriers, including Australia’s Qantas, now looking to renew their fleets, pressures have built up in the aerospace supply chain.

- Just 13 per cent of today’s global commercial fleet is of the latest generation.

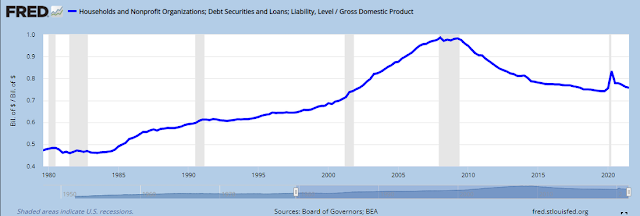

美國消費者財務體質

Comments

Post a Comment