Update #5: 美國供應鏈,Costco 12月銷售,BBBY 財報

美國供應鏈問題

Noahpinion有一篇關於美國供應鏈的訪談,是跟物流科技公司Flexport的CEO,非常棒,可以了解供應鏈的問題起源在哪裡。

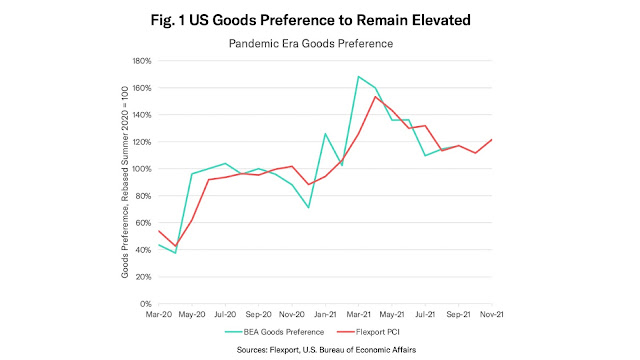

這次供應鏈不是只有供給端的問題,demand shock也是原因,疫情並沒有讓消費者變窮,反而讓消費者更有前,另外,疫情造成美國消費者停止消費服務,轉而買更多的商品:

- The supply chain crunch was started by increasing demand for goods, as consumers stopped spending on services. Americans in particular had more money in their pockets because they weren’t going on trips, spending at restaurants and bars, or attending concerts.

- The U.S. had the second-biggest shift towards goods, behind the UK, but we did see a similar shift in 23 out of the 25 countries for which the OECD had the relevant data, showing this is a global trend.

這跟疫情前是大轉向,因為美國在疫情前商品跟服務的比例很低,約在30%左右,雖然這是全球的現象,但美國的轉變是最大:

消費習慣轉變,但美國供應鏈的基礎建設趕不上,特別是在短短的一年內,這主要是過去20-30年對港口,鐵路的低度投資:

- Consumers are just buying more stuff than ever and our infrastructure, frankly, isn't ready for it.

- It's getting held back by dilapidated port infrastructure, by congestion, non-automated ports, and bad rail connections to the ports. We're just recognizing the pain of 20 years of not investing in our infrastructure.

- And we're feeling all that pain in one year right now. It’s increasingly difficult for truckers to pick up or drop off containers at ports and warehouses, leading to today’s congested ports, lots, and railyards.

另外就是大家所知道的,購買商品的管道,從傳統實體零售轉向電商,但兩者的物流系統不同,消費者行為大改變也造成整個物流系統大亂,以前是大家往實體店面買東西,電商則是把商品推向各個住家,這個更複雜,特別是當電商滲透率在一年內從20%左右跳到30%左右:

- One thing to note is that e-commerce logistics networks are fundamentally different in their geographical and physical space than that of traditional retail. They're more complicated because you are edge caching your inventory to be closest to your users instead of positioning everything in a distribution center in a single hub.

- You now have to position your warehouses all over the United States, making it exponentially more complicated. So the more people bought things online, the more these systems were overloaded.

美國不是製造大國,所以要更多商品,就必須要靠進口,就是從中國,然後上面的問題再度發生,短時間進口增加太快,除了美國港口無法負擔,缺乏工人跟司機使得不夠人力卸貨,貨櫃無法卸貨就開始累積,連同需要轉接的車架也缺

- So what we saw was an unprecedented increase in imports from China—as much as 20% more containers entering the United States than were leaving our ports since the start of the pandemic.

- As imports increased as much as 20%, exports actually decreased because the United States economy was slow to reopen.

- You can’t return empties, so you can't free up the chassis required to move full containers out of the port.

下面這張圖就代表了美國供應鏈的目前的惡性循環:

Costco (COST)

Costco的12月的銷售數字,依然強勁:

- 扣除汽油銷售的同店銷售YoY +11.5%,E-commerce YoY17.8%

- 成長主要來自於來店客數,US Traffic up 8.5% (vs +3.3% in Nov), global traffic up 9.8% (vs 5.5%)

- 12通膨與11月差不多

- 單月營收成長222億美金,YoY +16.2%

營收這麼大的公司還可以成長15%以上,一方面可以看出美國需求面仍很強,另一方面也看出Costco的競爭力,但股價近期跟著成長股下殺,PE 40倍也是反映了成長性,但Costco還是很好的長期持股標的,看看何時可以止穩。

Bed Bath and Beyond (BBBY)

居家用品零售商BBBY的財報,難得看到同店銷售有衰退的:

- Comparable Sales decline of (7)% versus Q3 2020 and a decline of (4)% versus Q3 2019

- On a Comparable Sales basis, the Company expects a high-single digit decline compared to the prior year period

公司的解釋是庫存不夠:

- verall sales were pressured despite customer demand due to the lack of availability with replenishment inventory and supply chain stresses that had an estimated $100 million, or mid-single digit, impact on the quarter and an even higher impact in December.

從這大概可以看出BBBY議價能力跟管理層的問題,很多零售商在Q4之前就開始建庫存,像Target,Costco都有,反而BBBY面臨庫存不足問題,然後丟包給供應鏈問題,但我看是管理層眼光不夠,沒有規劃,或者是BBBY的產業地位降低,議價能力較差,也難怪股價很弱,儘管公司狂買自家股票,沒基本面支撐,repurchase也只是浪費錢。

Comments

Post a Comment