Update #9: 保時捷EV,Nvidia新的商業模式,原物料交易商流動性危機,信用卡消費趨勢

保時捷EV計畫

“In 2030, the share of all new vehicles with an all-electric drive should be more than 80 per cent,” said Oliver Blume, chief executive, who added that the transition was “running faster [than Porsche] planned years ago”.

The brand’s first purpose-built electric car, the Taycan, has been far more successful than executives or analysts predicted. It was launched in 2020 and outsold the 911 model in 2021.

因為Taycan賣的比911好,保時捷開始積極擴展EV,連時間都講出來了,應該會看到越來越多的傳統車廠壓縮電動車的進程,尤其又看到油價到100以上。

Nvidia 新長出來的商業模式

CFO Colette Kress在Morgan Stanley的presentation:

But now we're entering into a new phase, a new phase that we are thinking about software and a business model for software to sell separately. Now software is incorporated in all of our systems and platforms today. What fuels so much of our data center focus on AI and on acceleration is the help that we have done in providing both a development platform and software, SDKs and others for that. But now we have an ability to monetize separately, a great business model for us and a great ability for us to expand our reach for many of the enterprises that we are working with in our data center business. Focusing on a key area, for example, our work in NVIDIA AI enterprise.

Nvidia這幾年一直都說自己是軟體公司,Jensen Huang幾乎在每次財報上都有提到這點,之前在訪問他們內部人士時,也有提到公司的軟體工程是比硬體工程師多。只是說目前軟體還是用來幫助硬體的差異化,提高硬體銷售,這點很類似Apple,現在要開始改變了,軟體開始有自己的monetization計畫,也很像Apple開始拓展服務的時候。一個是從Omniverse:

We have a new software offering, a software offering to approximately 30 million creators out there to begin their work using our Omniverse software.

另一個是自駕車:

And then lastly, our focus on automotive and providing software for AV cars. We have 2 very major important deals that we have done with Daimler, and then most recently with JLR, Jaguar Land Rover, to where their entire fleet will be operated with NVIDIA software. And we will have the ability to share that software with those OEMs and monetize it over the life of the cars being on the road.

歐洲與英國央行不願意支援原物料交易市場

金融時報報導:

Central banks have intensified discussions with energy trading firms calling for help to ease market strains sparked by the war in Ukraine, but are unlikely to unlock immediate extra support, according to people with knowledge of their talks.

自從俄羅斯打烏克蘭後,原物料價格大噴,這也使得原物料交易公司面臨資金問題,因為這些公司都會做期貨避險鎖價差,價格狂噴,期貨部位虧損,保證金就會增加,要跟銀行借錢也不容易

To move a cargo equivalent to one megawatt hour of liquefied natural gas priced at €97, traders must provide €80 in cash, straining their capital requirements, Hardy said.

這些交易商開始跟央行求救,但目前不願意,這新聞可以當作個警訊,看似不重要,對金融市場沒直接影響,但以2008年的經驗,某一個小市場發生流動性問題,一開始都是忽略的,但後面所連結到的東西才恐怖。

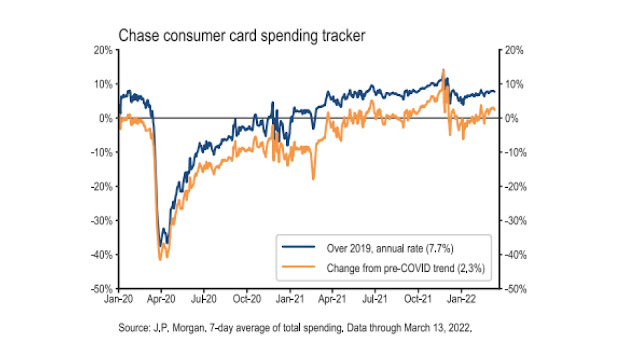

信用卡消費趨勢

美國最大發卡行JP Morgan Chase的信用卡消費趨勢

消費趨勢持續往上,但花在加油的支出上在戰爭後大增,不意外,但要看未來是否會壓縮到其他的消費支出。

另外,MasterCard的二月消費趨勢:

整體消費成長還是很好的8.7%,但看到電商只有成長4.4%,這成長率放緩的有夠大,另外看到餐廳,服飾,百貨公司跟奢侈品成長率都大幅往上,也難怪電商的成長率大幅下滑。

Comments

Post a Comment